Power to Choose Texas: Fixed vs. Variable Electricity Rates for Homeowners (No-Deposit Options) sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

The discussion will delve into the differences between fixed and variable electricity rates, explore the Power to Choose program in Texas, and shed light on the opportunities for homeowners to access electricity plans without deposits.

Fixed vs. Variable Electricity Rates

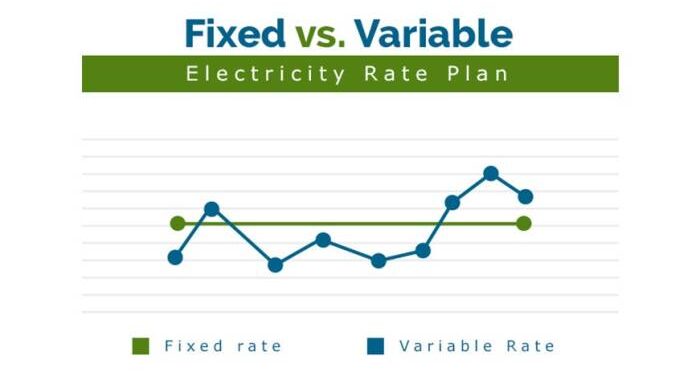

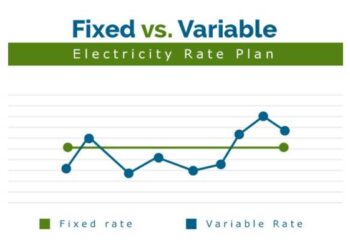

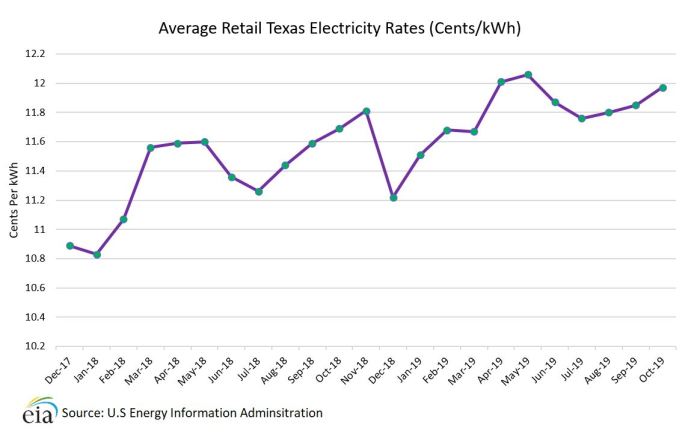

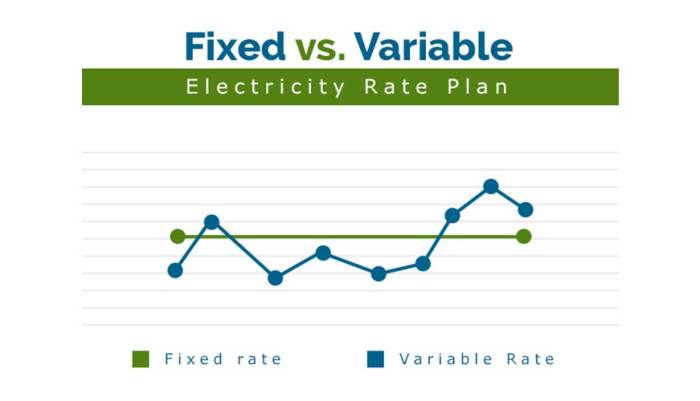

Fixed electricity rates refer to a pricing structure where the rate you pay for electricity remains constant throughout your contract term. On the other hand, variable electricity rates fluctuate based on market conditions, meaning your rate can change from month to month.

Fixed Electricity Rates

Fixed electricity rates provide stability and predictability for homeowners, as they know exactly how much they will pay for electricity each month. This can be beneficial for budgeting purposes, especially for those on a fixed income. However, if market prices drop, you may end up paying more than the current market rate.

Variable Electricity Rates

Variable electricity rates are directly tied to market conditions, allowing homeowners to potentially benefit from lower rates when market prices decrease. However, this also means that your electricity bill can increase if market prices rise. Variable rates can be more flexible but may result in unpredictable monthly bills.

Comparison

- Fixed rates offer stability and predictability, making it easier to budget.

- Variable rates can provide savings during times of low market prices but may lead to higher bills when prices rise.

- Fixed rates are ideal for those who prefer consistency, while variable rates may suit individuals who are willing to take on a bit more risk for potential savings.

- It's essential to consider your own financial situation and risk tolerance when choosing between fixed and variable electricity rates.

Understanding Power to Choose Texas

The Power to Choose program in Texas is a state-run initiative designed to provide residents with a platform to compare and select electricity plans from various providers. This program aims to empower homeowners by offering them transparency and flexibility in choosing the best electricity options for their needs.

Overview of Power to Choose Program

- The Power to Choose platform allows Texas residents to view and compare different electricity plans offered by various providers in the state.

- Residents can filter their search based on factors such as fixed or variable rates, contract length, renewable energy options, and more.

- By providing detailed plan information and pricing, the program enables homeowners to make informed decisions when selecting their electricity provider.

Significance of Power to Choose for Texas Residents

- Power to Choose offers residents the opportunity to find competitive electricity rates and plans that suit their budget and preferences.

- Through this program, homeowners can explore renewable energy options and support environmentally friendly electricity sources.

- The transparency and accessibility provided by Power to Choose help Texas residents avoid hidden fees and understand the terms of their electricity contracts.

No-Deposit Options for Homeowners

When it comes to electricity plans, homeowners often look for options that require no deposit. These plans offer a convenient way to get electricity without having to put down a large sum of money upfront.No-deposit electricity plans typically have certain requirements or conditions that homeowners need to meet in order to qualify.

While these requirements may vary depending on the provider, common conditions include a good credit score or enrollment in auto-pay for bill payments

No-Deposit Electricity Options

- Some electricity providers offer prepaid electricity plans where homeowners pay for their electricity usage upfront, eliminating the need for a deposit.

- Other providers may offer no-deposit plans for customers with a good credit history or those willing to enroll in auto-pay options.

- Certain providers may also have special promotions or deals that waive the deposit requirement for new customers.

Pros and Cons of No-Deposit Plans

- Pros:

- Convenient for homeowners who may not have the funds for a large deposit upfront.

- Allows for greater flexibility in managing electricity expenses.

- Can help build credit history for those with limited credit options.

- Cons:

- No-deposit plans may come with higher electricity rates compared to traditional plans.

- Some providers may charge additional fees or require a contract for no-deposit plans.

- Failure to meet payment requirements could result in disconnection of service.

Epilogue

In conclusion, navigating the realm of electricity rates in Texas offers both challenges and opportunities for homeowners. By understanding the nuances of fixed and variable rates, leveraging the Power to Choose platform, and exploring no-deposit options, residents can make informed decisions that suit their individual needs.

General Inquiries

What are fixed electricity rates?

Fixed electricity rates are set prices that remain constant throughout the duration of the contract, providing stability and predictability in monthly bills.

How do variable electricity rates work?

Variable electricity rates fluctuate based on market conditions, offering the potential for savings but also the risk of increased costs.

What is the Power to Choose program in Texas?

The Power to Choose program allows Texas residents to compare and select electricity plans from different providers based on their specific needs and preferences.

What are the requirements for qualifying for no-deposit electricity plans?

To qualify for no-deposit electricity plans, homeowners may need to undergo a credit check or choose a prepaid option that does not require a deposit.

What are the pros and cons of opting for a no-deposit electricity plan?

The main advantage is avoiding upfront deposits, but the downside could be higher monthly rates or limited plan options.